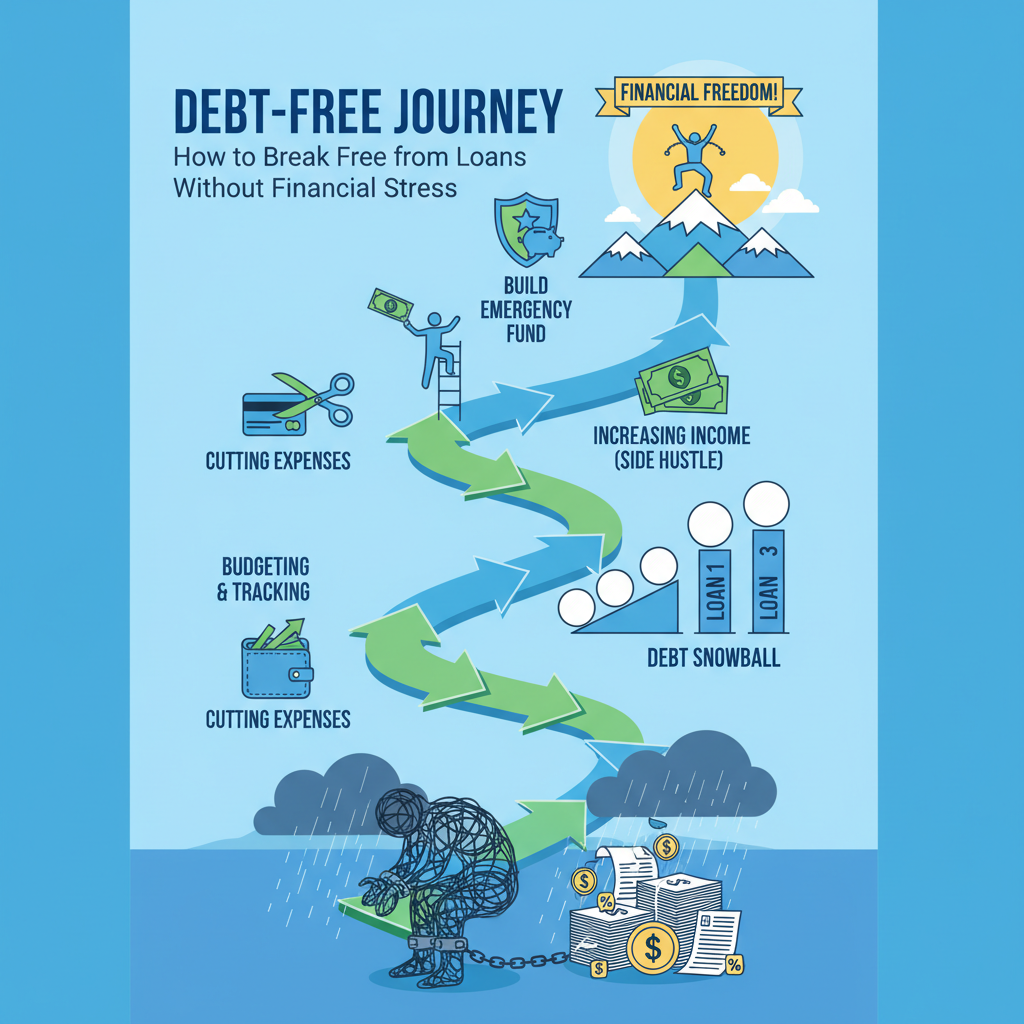

When EMIs pile up and calls from lenders become routine, many people start dreaming of a “debts‑free” life—but have no idea how to reach it without more stress. A debt‑free journey is not about overnight miracles; it is about structured steps that turn chaos into control, and control into freedom.

Step 1: Get Completely Honest About Your Debt

Most borrowers know they “have loans” but cannot clearly say how much, to whom, and on what terms.

- List every loan and credit card with current outstanding, interest rate, EMI, tenure left, and overdue status.

- Add informal debts too—friends, family, salary advances—because they also affect your monthly cash flow and mental load.

Seeing the full picture on one page may feel uncomfortable, but it is the first moment your debt stops being an invisible monster and becomes a solvable problem.

Step 2: Protect Essentials and Stabilise Cash Flow

Before talking about “becoming debt‑free,” you need to stop financial bleeding.

- Separate essential spending (food, rent, utilities, basic education, medicines) from lifestyle spending (eating out, subscriptions, upgrades, impulse shopping).

- Build a lean monthly budget where essentials are protected first, then EMIs and dues are planned realistically instead of emotionally.

The goal is not to live miserably forever, but to create surplus cash each month that can be directed toward a clean, structured exit from loans.

Step 3: Prioritise Which Loans to Tackle First

Not all loans are equal. Some are expensive, some are dangerous legally, some are just noisy.

- High‑interest unsecured debt (credit cards, personal loans, BNPL) usually deserves priority because interest and penalties snowball fastest.

- Secured loans that protect important assets (home, key business equipment) must also be serviced carefully to avoid repossession or legal trouble.

A simple rule: protect what keeps your life stable, and aggressively reduce what drains you without building assets. This is where a structured “debt snowball” (closing smaller debts first) or “debt avalanche” (targeting highest interest first) strategy can be chosen based on what keeps you more motivated and consistent.

Step 4: Use Restructuring and Refinancing Before Crisis Hits

If you still have some repayment capacity but EMIs are tight, act before things go out of control.

- Talk to lenders about EMI restructuring—longer tenure and lower monthly payments—to match your current income instead of waiting for defaults.

- Explore safe refinancing: moving from costlier debt (like credit card rollover) to lower‑interest personal loans or top‑ups, if your profile still qualifies.

These steps don’t remove debt, but they turn sharp, painful EMIs into smoother, manageable ones, reducing stress and freeing up some cash to build an emergency buffer.

Step 5: When Needed, Consider Legal Loan Settlement

For many borrowers already in deep distress—chronic defaults, job loss, business collapse—paying every rupee plus interest is simply unrealistic.

- In such cases, formal loan settlement or one‑time settlement (OTS) with the bank can reduce your payable amount through negotiated waivers of interest, penalties, and sometimes part of principal.

- This gives you a clear, finite figure to aim for instead of a constantly growing outstanding and endless calls.

However, settlement usually harms your credit score and leaves a “settled” remark for years, so it must be treated as a serious reset, not a casual discount. Getting professional guidance here is often wise.

Step 6: Stop Harassment the Right Way

A “DebtsFree” journey is not only about numbers; it is also about peace of mind.

- Borrowers in arrears are often subjected to aggressive recovery tactics—repeated calls, pressure, and sometimes behaviour that crosses legal and regulatory lines.

- You have rights to dignity, privacy, and reasonable contact; pushing back through proper channels (written complaints, escalation) is both allowed and necessary.

If calls are affecting your mental health, have one designated communication channel (email or a single phone) and respond in writing wherever possible. Structured negotiation and, when needed, help from professionals can convert raw pressure into a documented resolution path.

Step 7: Build New Habits While You Exit Old Debt

Becoming debt‑free is not only about closing accounts; it is about changing the behaviour that led there.

- Start a small but non‑negotiable savings habit—even ₹500–₹1,000 per month—so you experience what it feels like to pay yourself first instead of only lenders.library

- Track your spending weekly, not yearly. Many people discover silent leaks (fees, subscriptions, impulse spends) that, once fixed, create the extra cash needed for faster repayments.

These early habits ensure that when your settlements or closures are done, you don’t slip back into the same cycle.

Step 8: Plan Your Life After Debt

“DebtsFree” is not the end; it is a restart. Once your major loans are closed or settled:

- Give your credit profile time to heal—pay surviving obligations on time, avoid new unsecured loans, and use any necessary credit (like a basic secured card) with discipline.library

- Set clear goals for the money that is now free: emergency fund, insurance, small investments, and only then lifestyle upgrades.

The real success is when your past loan story becomes just that—past. A mindful, step‑by‑step approach can help you break free from loans without destroying your health, relationships, or future options, turning financial distress into a structured journey toward long‑term stability and genuine freedom from debt.